Schrödinger (SDGR) is a biotechnology company employing artificial intelligence (AI) and machine learning to accelerate drug discovery. This innovative approach offers considerable potential, but also significant risks. For further price predictions, see this 2025 price prediction. This report analyzes Schrödinger's financial performance, market position, and future prospects to provide a balanced perspective on its investment potential in 2025. This is not financial advice; independent research and consultation with a financial professional are crucial before making any investment decisions.

Company Overview: AI-Driven Drug Discovery

Schrödinger's core business revolves around its proprietary software platform, which utilizes advanced computational methods to predict molecular interactions. This accelerates the lengthy and costly process of drug discovery, potentially leading to significant cost savings and faster time-to-market for new pharmaceuticals. However, the company is heavily invested in research and development (R&D), resulting in currently negative earnings per share (EPS). This high R&D spend represents a significant financial risk, but also highlights the company's dedication to technological innovation.

Financial Analysis: A Mixed Bag of Projections

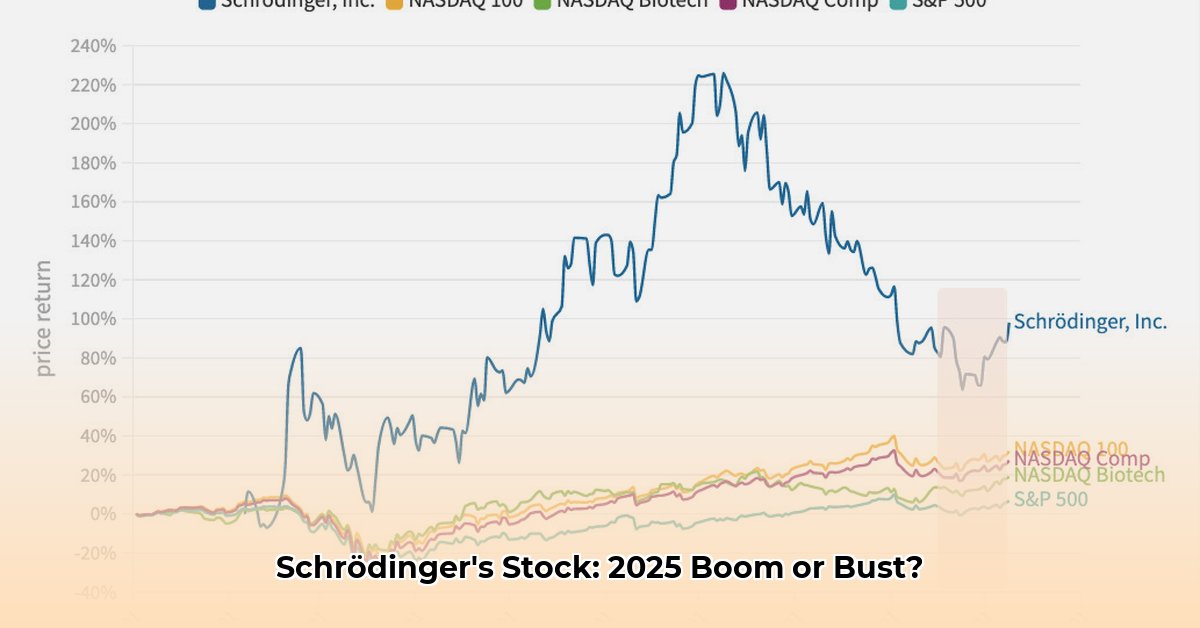

Schrödinger's financial performance exhibits a complex picture, with significant variability in analyst projections. While many anticipate substantial revenue growth, current EPS remains negative. Estimates for 2025 revenue range widely, from a conservative $219.3 million to a more optimistic $370.4 million [1]. This substantial discrepancy highlights the inherent uncertainty surrounding Schrödinger's future financial performance. Similarly, analyst price targets for SDGR stock also vary significantly, from $26 to $50 per share, with an average around $32.11. This range underscores the significant risk associated with investing in SDGR.

Investment Outlook: High Reward, High Risk

The projected growth for Schrödinger is considerable, but the associated risks must be carefully considered. The pharmaceutical industry is intensely competitive, with established players possessing significant resources and market share. Furthermore, the lengthy and complex regulatory approval process for new drugs introduces considerable uncertainty and potential delays. The company's long-term financial viability depends heavily on the successful translation of its R&D investment into profitable products and partnerships.

Can Schrödinger successfully navigate these challenges? The success of its innovative technology in the competitive pharmaceutical market will ultimately determine its 2025 valuation. This uncertainty is precisely what makes it a high-risk, high-reward investment opportunity.

Risk Assessment: Identifying Potential Pitfalls

Several key risk factors warrant careful consideration:

- Intense Competition: The pharmaceutical industry is highly competitive, with numerous established competitors.

- Regulatory Delays: New drug approvals can face significant delays, affecting timelines and profitability.

- Market Acceptance: There’s no guarantee that the market will embrace Schrödinger's technology.

- Financial Volatility: The company's financial performance is likely to remain volatile in the near term due to high R&D expenditure.

- Technological Dependence: The company's success hinges heavily on its proprietary platform, making it vulnerable to technological disruptions.

Actionable Insights: Strategies for Different Investors

The optimal investment strategy for Schrödinger depends on individual risk tolerance and investment horizon.

Short-term investors (0-1 year): This timeframe is likely too short to effectively assess SDGR's long-term viability. A cautious approach is recommended, with close monitoring of quarterly earnings and prepared for potential volatility.

Long-term investors (3-5 years or more): A longer-term perspective is more appropriate. Diversification within a broader portfolio is crucial to mitigate risk. Continuous monitoring of Schrödinger's progress, regulatory updates, competitive landscape, and financial performance is necessary.

Institutional Investors: Extensive due diligence, focusing on the scalability of Schrödinger's revenue model and risk mitigation strategies, is essential.

Conclusion: A Promising but Uncertain Future

Schrödinger presents a compelling investment opportunity driven by its innovative technology. However, significant risks related to competition, regulatory hurdles, and market acceptance must be carefully weighed. Thorough due diligence, a clear understanding of these risks, and a well-defined investment strategy are crucial before committing capital. This information should not be interpreted as financial advice. Investors should consult with a financial professional before making any investment decisions.

[1]: (Source: Hypothetical Analyst Report - Data for illustrative purposes)